When discussing the internet, the economic concept that seems to have made the largest dispersion into popular discourse is the concept of ‘network effects’. “Facebook is unconquerable because of positive network externalities.” “Product X must reach the tipping point so that network effects can take over,” etc.

This sub-field is often treated as if it is more-or-less mature (and it may well be), but there is a serious theoretical ambiguity within the economic literature about exactly what a network effect is based upon.

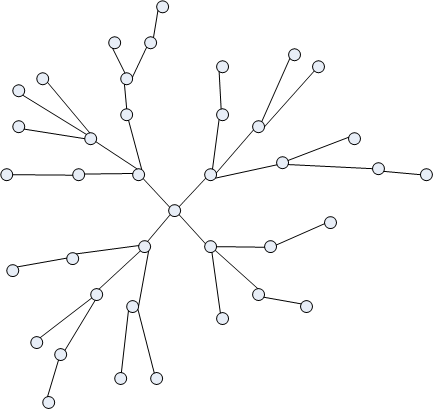

The original incarnation of the term deals with a good whose value increases as the number of nodes on the network increases. The traditional example is the fax machine. As more people received and hooked up their fax machines, my fax machine (or potential fax machine) increased in value because the number of people I could contact with the device increased. This is a node-based network effect.

But there is a difference between this node-based effect and a quantity-based effect. For instance, imagine a good whose value is not connected to how many other people use the good but to how much of the good exists out in the world. This quantity could be held by a few large entities, or distributed among many smaller other entities. The important factor is: no matter to whom a good is sold—even if they already own the good and are buying a second or a third—the value one places on the good increases as this good is bought. I call this quantity-based good ‘Facebook’ and the node-based good ‘fax machines’ for simplicity from now on.

But why ‘Facebook’? It seems that the reason Facebook is valuable is because all of one’s friends are on it. This would make it a traditional node-based network effect good, and no different from ‘fax machines’.

Here we reach the weaknesses of economic theory: all economic theory is necessarily a simplification. According to Ariel Rubinstein (2006) economic theorists are fable tellers (which is not a bad job, to be sure). They simplify life, create models that in some instances have absurd results, and hope that their models can still be true-enough-to-life to tell people something interesting and valuable about the world they live in.

Even in the first network goods papers the theorists recognized that the node-based concept was a simplification. Obviously adding a family member to the fax network is more valuable than adding a stranger (see Farrell and Klemprerer). Also, sometimes nuisance nodes pop up whose addition to the network degrades quality. But the general trends hold—as more people use the fax network, more value is placed on owning a fax machine.

So there is no purely node-based network effect good. Likewise, there is also no good that has utility curves that look like those I assigned to the good called ‘Facebook’. But by treating these extreme cases as theoretically possible ‘corner solutions’, we can attempt to be fable tellers discussing the relative importance of the different factors by talking about moving away from one corner and towards another.

Facebook is valuable for me because of how flushed out my friends’ Facebook pages are and how often we reconnect. So Facebook (though still partially based on node-based network effects) is more valuable to me the more time my friends spend on Facebook. If my friends each spent an hour a month on Facebook, it would not be worth as much as it is when they spend 10+ hours a month. But fax machines are a more ‘bursty’ kind of communication. The value of a fax machine is of having one turned on and left alone in the house.

The fax machine is clearly worth more to me if people use it more (it is not a corner solution), but this effect is not as important as it was when considering the value I place on Facebook. Unless you never check your fax machine, the fact that you are not proactively reestablishing connections through fax does not really degrade how much I value the machine. It sits idly in my house, and alerts me when it needs attention—the quantity of nodes is more important. Facebook requires updating and continuously refreshing contacts/uploading photos—nodes are still important, but the quantity of time spent online is more important than it was for fax machines.

Therefore, if we think of network effects as being on a continuum, extending from one extreme where only nodes matter to the other where only quantity matters, we might find that goods online are located in a different part of the continuum than the goods we were comparing them to before the internet.

This has implications on how firms treat consumers already in the network. If only the number of nodes is important, the competition will be more fierce over the marginal consumer who is indifferent about joining the network. If the quantity purchased is relatively more important, firms will also take into account the effects of the additional quantity purchased by inframarginal consumers (those ‘not on the margin’ or already in the network).

The specifics of the model are a bit mathematically complex, but the difference between these cases comes down to the reverberation of the increased number of nodes/quantity. The firm obviously still cares about the inframarginal consumers in the ‘fax machine’ model. But the firm benefits more from a new customer than from a customer buying a second fax machine because of the increase in value that other consumers enjoy–part of which the firm can now extract.

On the other end of the spectrum, the value created by the increase in quantity purchased is the same if someone buys a second good or if someone enters the market for the first time. This can explain why some network good providers spend relatively more time catering to their current customers (who are supposedly ‘locked in’) than they would be predicted to.

The real concern is that this differentiation has not been recognized in the network effects literature. Or, perhaps more fundamentally: should the things on this continuum even be called network effects anymore, or should they just be subsumed into a more general category like ‘consumption externalities’? The distinction is important because there are times when it will lead to different predicted results in models because the change in inframarginal demand was previously not considered as affecting the value of the good for others.

Theoretical economists may only be fable tellers, but people seem to be paying attention to this specific story. It is worth properly defining the factors upon which it is built.